Range Resources paid $31.7M; Washington County top impact fee recipient again this year

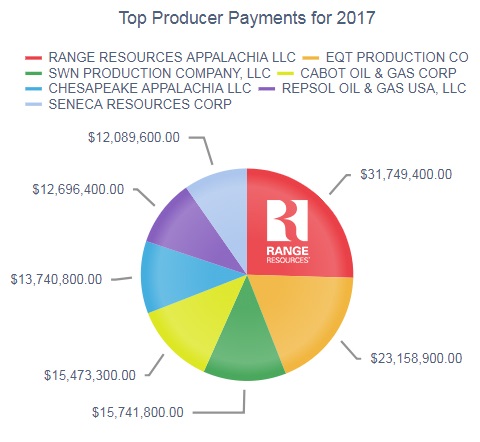

The Pennsylvania Public Utility Commission recently announced the distribution of more than $209 million in Impact Fee payments collected from natural gas drilling companies—a number that represents a $36 million increase over last year’s total. Of the 67 counties in Pennsylvania, Washington County once again received the highest amount, a total of $7.3 million in the Commonwealth’s unique tax on natural gas companies. And among Marcellus Shale drilling companies, Range Resources repeated its performance as top-payer, coming in this year at $31.7 million.

The Pennsylvania Public Utility Commission recently announced the distribution of more than $209 million in Impact Fee payments collected from natural gas drilling companies—a number that represents a $36 million increase over last year’s total. Of the 67 counties in Pennsylvania, Washington County once again received the highest amount, a total of $7.3 million in the Commonwealth’s unique tax on natural gas companies. And among Marcellus Shale drilling companies, Range Resources repeated its performance as top-payer, coming in this year at $31.7 million.

Townships in Washington County are also seeing increases: Cross Creek, Amwell, Nottingham, Robinson and North Strabane are all receiving more in Impact Fees this year than ever before, a trend that has local leaders emphasizing the importance of Pennsylvania’s uniquely structured system.

“Impact Fees have improved our residents’ lives in a number of ways,” said Rachel Warner Welsh, Township Manager in Cross Creek Township. “We’ve been able to invest money in local parks, we have a newly remodeled Senior Citizen Center, we’ve been able to improve our fire safety efforts with better equipment and training, and we’ve made significant road improvements—putting down four times the amount of asphalt that we used to use.”

Cross Creek Township is receiving approximately $520,000 in Impact Fees this year, the most the Township has ever received. Welsh hopes to see these funds continue to go directly to communities that are impacted by natural gas development, and she also wants people to understand that critical projects might otherwise go unfunded.

“There was a time when we would have been hard pressed to fund simply the engineering required for two of our large road maintenance projects: the Parker Road culvert project at $250,000, and the Donahoe Road storm drains project at $152,000. Both have been completed thanks to Impact Fees, along with numerous small culvert projects. And considering the amount of rainfall we’re seeing this year, I am certain those culverts helped to avoid hazardous driving conditions.”

Welsh also says winter maintenance has been much-improved with upgraded equipment, along with a new furnace, replacement of the exterior steel siding, new insulation and three new insulated garage doors and openers at the Road Department. Future plans include additional investments in local parks, and continued investment in the Township’s future.

Jodi Noble is the Manager in Chartiers Township, which received $562,000 in impact fees this year. To date, Chartiers Township has spent more than $2 million in Impact Fees on road improvement projects, along with another $1.1 million put toward parks and recreation, water and sewer projects, public safety, and a capital reserve fund.

“We budgeted conservatively this year, estimating that we would get about $420,000 in Impact Fees. So the fact that we’re actually getting well over that is going to be a big help, we’ve had some road emergencies due to all of the rain we’ve been getting, and those dollars will help us make those unanticipated but necessary repairs.”

Noble says future plans also involve funding two important sewer projects, McClain Farm Road and the Midland Sewer Project. Repairing and replacing outdated systems is a priority for many local townships.

“The projects we spend this money on just wouldn’t be possible without an impact fee,” said Noble. “And it’s important to also understand that the term Impact Fee is exactly what it implies, a fee that helps mitigate the impacts of drilling in local communities, and helps us invest in our communities.”

This year, Robinson Township will receive just over $339,000, nearly double last year’s amount and the Township’s highest Impact Fee payment ever. In past years, Impact Fee dollars have helped the township make purchases like a dump truck, a high lift, and a tractor-mower for roadside grass and brush maintenance.

“We also recently built a new township garage for public works vehicles,” said Supervisor Rodger Kendall. “And we’ve been paving many of our back roads too. We couldn’t do this without the Impact Fee dollars. Not to mention having those dollars also frees up more money in our general fund, which has allowed the township to hire a third full-time person to work on the road maintenance in the township, along with adding to our police presence. So it goes beyond the projects we specifically direct Impact Fee dollars to.”

Kendall wants to see Impact Fee disbursement continue unchanged. “I think the way the money is shared now is very fair. The money goes to the communities that are directly impacted by the natural gas industry. And in Robinson, at the Township level, we haven’t raised taxes in four and a half years. We don’t need to, because we receive the Act 13 dollars.”

North Strabane Township also received its highest total yet, as the Township netted nearly $500,000 in Impact Fees this year. “So far, we have spent Impact Fee dollars on capital purchasing and paving for our infrastructure and public safety,” says Township Manager Andrew Walz. “The money has gone to support our volunteer fire department, the purchase of emergency service equipment, and road paving. This money allows for us to more greatly invest in our infrastructure and ensure our emergency services have the tools and training necessary to best serve our residents.”

While the majority of the Impact Fee revenue generated goes directly to counties and municipalities with natural gas wells, a portion is also allotted for environmental initiatives to all counties regardless of whether the county has any wells located within its borders. For example, over $100 million has been disbursed for watershed protection, parks, trails, recreation, open space conservation and farmland preservation projects while over $125 million has been distributed to fund water and sewer infrastructure projects.

Importantly, supervisors and managers who rely on Impact Fee dollars as they create annual budgets for local communities would like to retain decision-making power over how and where the money is spent. “We oppose any change to legislation, including a severance tax, that would jeopardize those funds,” said Welsh. “Let local officials decide how that money should be reinvested in our community, not someone in Harrisburg.”